The Future of Chip Manufacturing Innovation

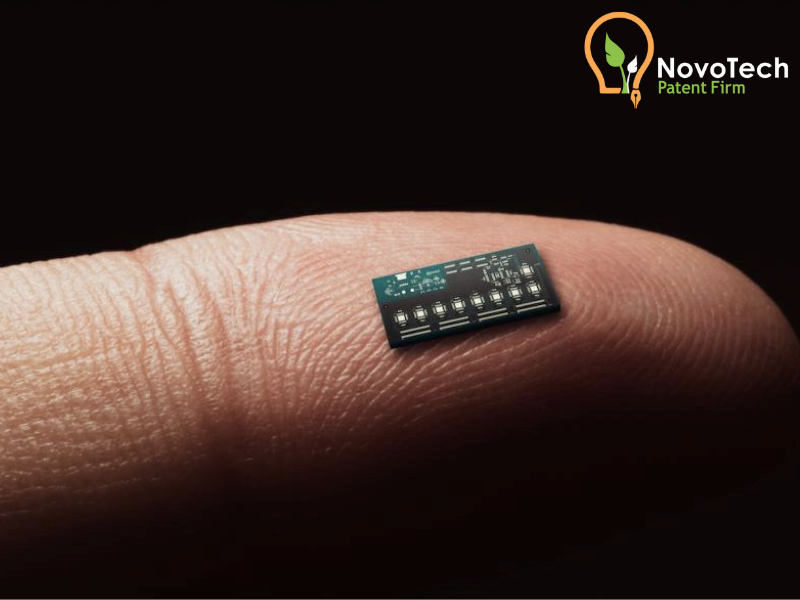

By Babak Akhlaghi on March 14, 2025. I’ve been watching the semiconductor industry for years, and what’s happening now is truly groundbreaking. While many see Intel 18A process testing by Nvidia and Broadcom as a routine business strategy, it may mark a significant shift in the semiconductor landscape, with potentially transformative implications for global chip manufacturing.

All our computing devices run on chips, and the companies that dominate manufacturing processes will be positioned to reap enormous financial rewards. If Intel 18A process passes Nvidia and Broadcom’s testing, it could be a game-changer – not just for Intel’s business, which has been suffering, but for the entire intellectual property landscape of semiconductor manufacturing.

Manufacturing Patents: The New Battleground

From an IP strategy perspective, chip manufacturing capabilities are becoming increasingly valuable – perhaps even more important than chip design itself. This represents a fundamental shift in where value lies in the semiconductor industry.

Only about 12% of chips are currently made in the US, with the rest manufactured overseas by giants like TSMC and Samsung. This dependency creates enormous risk that American policymakers have finally recognized. The 2022 CHIPS Act, with its $52 billion investment, aims to encourage both American and foreign companies to manufacture domestically.

A significant portion of this investment is dedicated to Intel. Why? Because whoever controls chip manufacturing controls the future of electronics. With massive investments flowing not just from the US but also Japan, Korea, and major companies worldwide, we’re entering an era of accelerated innovation – and with it, new generations of patents.

Collaboration Before Confrontation

The rapid expansion of technology in this space suggests we’ll initially see more collaborations and cross-licensing arrangements rather than immediate litigation. Companies like TSMC, Intel, and Samsung heavily protect their R&D investments, but I suspect litigation initiated by any one of them would trigger countersuit for patent infringement, eventually resulting in cross-licensing agreements.

We’ve seen this pattern before. Global Foundries sued TSMC and others over 16 manufacturing patents a few years ago, and the case ultimately settled through cross-licensing between their portfolios.

However, this collaboration model only works for companies actively investing in this area and generating their own IP. Companies that fall behind in their patent portfolios lose strategic leverage for cross-licensing negotiations and may instead face hefty licensing fees if infringement is established.

Intel’s Strategic Position

I don’t believe Intel 18A process will overtake TSMC’s manufacturing lead, but if successful, it will help close the gap. What’s more intriguing is what happens if a company like Nvidia, primarily known for chip design rather than manufacturing, begins acquiring manufacturing process patents.

Such a move would signal possible interest in making their own chips – a significant disadvantage for companies like Intel and TSMC, who would lose a major customer. This vertical integration could reshape power dynamics throughout the industry.

Government Intervention Changes the Game

US government funding through the CHIPS Act creates new obligations on how companies may utilize their patents. Any invention created with US funding must include a sponsorship statement on patent applications. While ownership of these inventions remains with companies, the government retains certain rights – like royalty-free licenses to use the technology.

The government may also impose export restrictions, preventing CHIPS Act-funded technology from being transferred to countries like China. These constraints add complexity to the IP landscape beyond traditional market competition.

Semiconductor Patent Wars Will Be Different

Patent wars in semiconductor manufacturing will differ fundamentally from those we’ve seen in software, smartphones, and pharmaceuticals. Semiconductor manufacturing involves an intricate global supply chain including raw material suppliers, equipment manufacturers, foundries, and design houses. A patent war could disrupt this interconnected network, potentially halting production across multiple industries that rely on semiconductors – from automotive to consumer electronics to defense.

Manufacturing semiconductors requires enormous capital investment, and patent disputes will only increase the barriers to entry. More importantly, a patent war would disrupt the cross-licensing arrangements that currently help companies access key technologies.

Winners and Losers

The potential winners in a semiconductor patent conflict will be larger companies with significant financial capital to invest in R&D and develop new manufacturing processes. They’ll have robust patent portfolios to leverage for licensing and cross-licensing should disputes arise.

The losers will be smaller companies without the financial resources to enter this high-barrier market and lacking the patent portfolios necessary for cross-licensing negotiations. They’ll likely face significant licensing fees just to utilize essential manufacturing processes.

Patent Strength and Strategy

Unlike software patents, which face increased vulnerability under patent eligibility challenges, chip manufacturing process patents typically make for stronger intellectual property. When the closest prior art has been thoroughly examined during prosecution, these patents create formidable legal protections.

The possibility of design-around solutions always exists, which is where seasoned patent attorneys become crucial. They minimize design-around risk by including only key steps in independent claims while avoiding terms that can be narrowly construed. Dependent claims then flesh out key aspects of the invention.

I expect we’ll see many continuation applications for key patents in this area. Competitors will monitor technological developments and massage claims in continuation applications to read on competitors’ processes – another strategy skilled patent attorneys employ to block design-arounds.

The International Dimension

With Intel being American, TSMC Taiwanese, and Samsung Korean, national interests and trade policies will inevitably influence patent enforcement and licensing negotiations. These companies will continue heavily investing in protecting their innovations both nationally and internationally – it’s their leverage, and they won’t surrender it.

Countries themselves will invest heavily given the strategic importance of semiconductor manufacturing. Trade policies like tariffs and export controls can influence patent enforcement. US restrictions on exporting advanced semiconductor technologies to China, for instance, complicate licensing negotiations involving Chinese firms.

The US may increasingly pressure trading partners to align with American policy or face trade restrictions or tariffs – a trend we’re seeing more frequently.

Regional Patent Blocs

Beyond the US, countries across Europe and India are making massive investments in semiconductor sovereignty. Their economic futures depend on it. This will naturally drive innovation and patenting activity across new regions.

It will be fascinating to see if countries that have historically lagged can close the gap with leaders like TSMC. While possible if Taiwan or TSMC diverts attention from this sector, it seems unlikely given semiconductors are the cornerstone of Taiwan’s economic power.

As more countries invest, we could see regional patent blocs forming around different manufacturing processes. This might drive further innovation and cross-licensing, but could also increase patent disputes, particularly from entities generating IP without manufacturing capabilities.

Strategic Positioning

Nvidia and Broadcom’s decision to test Intel 18A process is fundamentally strategic. No company wants all their eggs in one basket – diversifying chip suppliers creates resilience. Even without friction between TSMC and Nvidia, one can imagine scenarios where the US imposes penalties on American companies manufacturing chips overseas.

Currently, the US lacks capacity to produce more chips domestically, but as that capacity develops, companies like Nvidia and Broadcom benefit from having American suppliers.

The Future of Semiconductor Patents

Looking ahead, I believe we’ll see key innovations across manufacturing techniques, equipment innovations, and materials science breakthroughs. With recent advancements in quantum technology, we’re entering a new era of discovery for novel materials that could revolutionize not just semiconductors but numerous technological fields.

The rise of supercomputers capable of running AI applications locally instead of in the cloud will drive significant advancement and IP generation in specialized chip manufacturing processes.

The silicon battlegrounds are forming. The question isn’t whether patent conflicts will emerge in semiconductor manufacturing, but when and how intensely they’ll reshape the industry that powers our digital world.

Stay Informed with Expert Insights!

Want more valuable tips on navigating patent law and protecting your intellectual property? Join our free weekly newsletter for the latest updates, expert advice, and exclusive content straight to your inbox. Subscribe today and never miss out on essential information that can make all the difference in your patent journey! Subscribe to our Newsletter